Protecting a Tenant Who Conducts Her Business from Her Apartment

June 26, 2015

Itkowitz PLLC recently represented a Rent Stabilized tenant in an apartment in a very nice Hell’s Kitchen townhouse. The building had just changed hands and the new owner was looking for ways to pressure the Rent Stabilized tenants in order to get them to move. There was not very much that the landlord could do to this family. They had been in the apartment for almost twenty-five years and paid the rent like clockwork. They really did primarily reside in the unit and they were not doing anything to violate the lease. But the landlord still managed to come up with a pressure point.

Itkowitz PLLC recently represented a Rent Stabilized tenant in an apartment in a very nice Hell’s Kitchen townhouse. The building had just changed hands and the new owner was looking for ways to pressure the Rent Stabilized tenants in order to get them to move. There was not very much that the landlord could do to this family. They had been in the apartment for almost twenty-five years and paid the rent like clockwork. They really did primarily reside in the unit and they were not doing anything to violate the lease. But the landlord still managed to come up with a pressure point.

The landlord sent tenant a letter accusing her of violating her lease she operated her business in the apartment. In this case, the allegation that the lease was being violated was ridiculous, but the tenant was scared, and we had to explain to her, and ultimately her landlord, how specious a claim this was.

Here are the rules.

First, we look at what types of business are allowed to be run from apartments. The Zoning Resolution of the City of New York § 12-10 (“ZR 10-12”) has this to say about carrying on an occupation inside one’s apartment:

(a) A “home occupation” is an accessory use which: is clearly incidental to or secondary to the residential use of a dwelling unit…; is carried on within a dwelling unit…by one or more occupants of such dwelling unit, except that, in connection with the practice of a profession, one person not residing in such dwelling unit…may be employed; and occupies not more than 25 percent of the total floor area of such dwelling unit…and in no event more than 500 square feet of floor area.

(b) In connection with the operation of a home occupation, it shall not be permitted:

(1) to sell articles produced elsewhere than on the premises;

(2) to have exterior displays, or a display of goods visible from the outside;

(3) to store materials or products outside of a principal…building;

(4) to display, in an R1 or R2 District, a nameplate or other sign except as permitted in connection with the practice of a profession;

(5) to make external structural alterations which are not customary for residences; or

(6) to produce offensive noise, vibration, smoke, dust or other particulate matter, odorous matter, heat, humidity, glare, or other objectionable effects.

(c) Home occupations include, but are not limited to: fine arts studios; professional offices; teaching of not more than four pupils simultaneously, or, in the case of musical instruction, of not more than a single pupil at a time.

(d) However, home occupations shall not include: advertising or public relations agencies; barber shops; beauty parlors; commercial stables or kennels; depilatory, electrolysis or similar offices; interior decorators’ offices or workshops; ophthalmic dispensing pharmacy; real estate or insurance offices; stockbrokers’ offices; veterinary medicine.

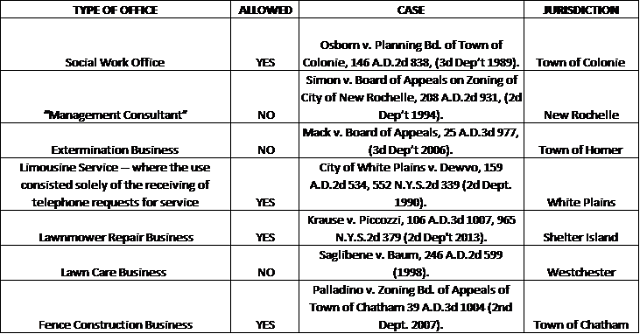

While the statute names certain types of business allowed and not allowed, there is a quite a bit of grey area. We did a survey of existing case law and below we include a chart that shows the types of uses permitted or not permitted. Unfortunately, the outcomes seem almost arbitrary, and the geographical locations of these cases also cast doubt upon the amount of guidance they provide for New York City – a Lawnmower Repair Business is permissible on Shelter Island but a Lawn Care business is not permitted in Westchester.

Additionally, the statute permits a home business to have an employee on the premises. Dept. of Buildings v. Owners and Occupants of 86 Prospect Park Southwest, OATH Index N. 1900/06 (2007).

Back to our story. Our client’s business was clearly incidental to (or secondary to) the residential use of the dwelling unit and is only carried on by the client-tenant, with no employees. The business was really just her computer and did not physically take up more than twenty-five percent (25%) of the apartment. The business did not violate any of the prohibitions for a home business listed in the statute. The business did not sell articles, have exterior displays, store materials, cause noise or vibration or smoke, etc.

So, we here at Itkowitz PLLC sent a letter to the landlord explaining the law. After a few discussions and a few emails, the matter concluded amicably and without litigation. The landlord in this story took a shot, realized he was up against a tenant adversary (represented by Itkowitz PLLC) committed to protecting her apartment and asserting her rights, and backed off.