Can I lose my Rent Stabilized apartment because I was away caring for a sick relative?

March 2, 2025

For the next few months in 2025, I am going to spend some time in these pages cross-promoting my very popular podcast, the Tenant Law Podcast – listen on Apple, Spotify, YouTube, or wherever there are awesome podcasts. This blog post expands on Tenant Law Podcast Episode 19.

Today we answer the question of podcast listener Damien from Williamsburg (of course, this is not his real name) who asks, “My landlord is suing to evict me from my Rent Stabilized apartment for nonprimary residence; but I swear I live here in the apartment. My travels and absence from the apartment are directly related to the illness of my mother (who lives outside of NYC), whom I needed to assist until her passing in 2023. I was unaware of the legal requirement of residing in a Rent Stabilized apartment for at least 183 days a year. I wish I knew about this requirement before, but English is not my first language. I have a lawyer, but I would like to know if I am going to lose because I was gone for more than 183 days?”

First let’s set the stage with some context.

A Rent Stabilized apartment is a great thing to have. A Rent Stabilized apartment can be a forever home.

One of the requirements for a tenant to remain Rent Stabilized is that the tenant must live in the apartment as their “Primary Residence”. Rent Stabilization Code § 2524.4. Therefore, one of the most common grounds upon which a landlord can attempt to evict a Rent Stabilized tenant is that the tenant does not occupy the apartment as her primary residence. To answer Damien’s question – we essentially need to answer the question – What does “Primary Residence” in the Rent Stabilization context mean?

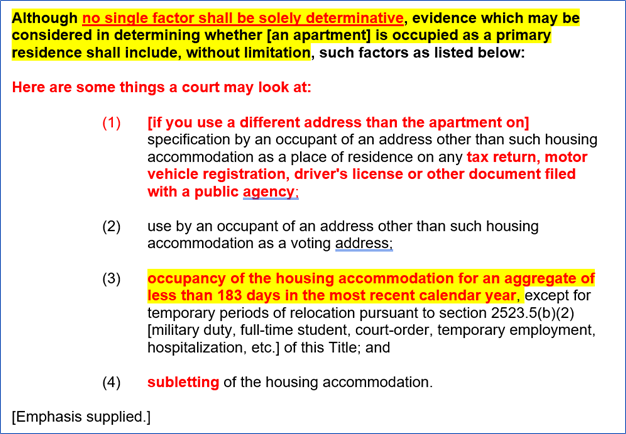

Let us start with the relevant statute. We always start with the statute. Rent Stabilization Code § 2520.6(u) specifically tells us about Non-Primary Residence claims. I diagramed the statute in the image below (although I will keep the text there as well in case you cannot see the diagram).

Rent Stabilization Code § 2520.6(u):

“Although no single factor shall be solely determinative, evidence which may be considered in determining whether [an apartment] is occupied as a primary residence shall include, without limitation, such factors as listed below:

Here are some things a court may look at:

- [if you use a different address than the apartment on] specification by an occupant of an address other than such housing accommodation as a place of residence on any tax return, motor vehicle registration, driver’s license or other document filed with a public agency;

- use by an occupant of an address other than such housing accommodation as a voting address;

- occupancy of the housing accommodation for an aggregate of less than 183 days in the most recent calendar year, except for temporary periods of relocation pursuant to section 2523.5(b)(2) [military duty, full-time student, court-order, temporary employment, hospitalization, etc.] of this Title; and

- subletting of the housing accommodation.”

[Emphasis supplied.]

Thus, we see that 183 days is one factor that may be considered, but that factor alone is not determinative. It also matters why the tenant is not there.

There are no absolute bright line rules when it comes to determining what constitutes a non-primary residence; the cases are highly fact specific. Second 82nd Corp. v. Veiders, 51 Misc.3d 142(A) [App Term 1st 2016]. I like to say that non-primary residence cases are like snowflakes, no two are exactly alike. But by studying real-life cases, we can begin to understand how it works.

My law firm once won a case where we represented a tenant being sued for non-primary residence. The tenant was a tenured professor at a university in New York City. His wife was suffering from a terminal illness. Their daughter was a doctor in Texas. The wife went to Texas to be with their daughter for the end of her life. Tenant followed and was gone from the apartment for nearly two years. But the apartment was never sublet. Tenant resumed his teaching job at the university when he returned to New York, which was shortly after his wife’s death.

Here is another case similar to Damien’s situation, Lance Realty Co. v Fefferma, 5 Misc3d 134(A) (App Term 1st 2004):

“The evidence, fairly interpreted, supports Civil Court’s determination that the subject rent stabilized apartment is tenant’s primary residence. Tenant maintained bank, brokerage and utility accounts at the New York City address, which he also used for tax returns and voting. Tenant’s furnishings and personal possessions are in the New York City apartment. While tenant acknowledged spending considerable time in Florida, helping to care for his elderly mother (aged 98 at the time of trial), that circumstance does not in itself mandate a finding of nonprimary residence, particularly since tenant had no ownership interest in his mother’s Florida apartment and slept on a sofa bed in the living room during his stays there”.

You can imagine, however, how these cases would have come out differently:

- if the relative had died and the tenant had remained in the other state for over a year;

- if the tenant had moved his driver’s license and car registration to Florida or Texas;

- if tenant posted on social media that he was so glad he moved out of New York. If those circumstances were present, it might be a different outcome.

Today we discussed several things that courts consider when trying to determine whether a tenant occupies their Rent Stabilized apartment as a primary residence:

- Government documents

- How much time you were away

- Sublet

- Why were you gone

- What is going on with your job

- What is going on with your possessions

- Social media

But there are so many other factors considered by courts in these cases. Again, these matters are very holistic and fact-determinative. There is a free 45-page booklet about this topic on the Tenant Law Podcast website entitled “How to Protect Your Rent Stabilized Apartment from a Non-Primary Residence Claim”. That booklet covers everything I said today and much more. In the booklet I cover 32 different categories of proof that courts consider. The booklet is free.

Damien, I hope this information has helped you and your lawyer out.

Respectfully submitted,