Update April 6, 2020: The article below is still valid – but also read The More Things Change, The More They Stay the Same – The Court of Appeals Beats Back Retroactive Enforcement of the HSTPA in Regina v. DHCR!

Updated August 11, 2019 (Originally published June 17, 2019)

I represent as many residential tenants as I do residential landlords, probably more tenants at this point. I am neither a residential tenant nor a multifamily real estate investor. I got no horse in this race. Therefore, as always, you can rely on me to tell you what’s really going on.

This article will deal only with the changes to the Rent Stabilization Law in New York City as codified in a new law entitled, the Housing Stability Tenant Protection Act of 2019 (“HSTPA”). I am writing a separate article about the Act’s changes to other real property laws, which will affect ALL tenants in New York City, and that article should be up in a few days.

I. READ THE LAW

This article is NOT exhaustive as to the 2019 changes in the Rent Stabilization Law in New York City. This article covers what I think my readers will be most interested in.

II. WHY THE LAW NEEDED TO CHANGE

As I explained in these pages years ago, a bad trend developed over the last 20 years in New York City multifamily housing, whereby speculators over-paid for buildings containing Rent Stabilized apartments, with the intention of raising the rents and eventually deregulating the apartments, thus raising the rent roll substantially to make a large and quick profit on these assets.

But the rent could only go up and apartments could only be deregulated if long-term existing tenants vacated. This prompted the speculators to bring legal cases against many long-term tenants, not always based on solid grounds. It also prompted the speculators to buy tenants out and/or harass tenants out. When vacancies occurred, higher rents and deregulations depended on the owners doing six-figures worth of work in an apartment. Often, that work never really happened. Landlords would often lie about the amount spent on individual apartment improvements. Add to this the rampant abuses related to “Preferential Rents”, and that’s how you end up with 250,000 illegally deregulated Rent Stabilized apartments.

The law needed to evolve to curb these abuses. Nevertheless, all of the law-abiding good landlords get hurt along with the nefarious ones.

III. HOW THE RENT STABILIZATION LAW CHANGED IN NEW YORK CITY IN JUNE 2019

A. There is no longer a rent-increase pathway to deregulation.

In June 2019, the New York State legislature took away the incentive for a landlord to seek a vacancy. The new law repeals statutes that allowed units to be deregulated on vacancy if the rent reached $2,744, or if that rent is lawfully achieved while a tenant earning $200k a year or more resided in the apartment. In short, there is no longer a rent-increase pathway to deregulation.

B. The legislature severely limited the ability of owners to take rent increases on vacancies.

Moreover, the legislature severely limited the ability of owners to take rent increases on vacancies, further dampening a landlord’s appetite for tenant turnover. The new law:

- Repeals the statutory vacancy bonus, which allows landlords of Rent Stabilized apartments to create an automatic increase in rent up to 20% on vacancy; and

- Repeals the vacancy longevity bonus.

The rent for the new tenant is the rent that the old tenant paid, plus applicable Rent Guidelines Board increases, which historically are very low (as I write this, they are 1.5% for a one-year lease and 2.5% for a two-year lease). The new law says:

“Any tenant who is subject to a lease on or after the effective date of a chapter of the laws of two thousand nineteen which amended this subdivision, or is or was entitled to receive a renewal or vacancy lease on or after such date, upon renewal of such lease, the amount of rent for such housing accommodation that may be charged and paid shall be no more than the rent charged to and paid by the tenant prior to that renewal, as adjusted by the most recent applicable guidelines increases and any other increases authorized by law.”

Furthermore, individual apartment improvement increases (“IAI’s”) have changed dramatically pursuant to the new law. Landlords may only spend $15k in 15 years on IAI’s. Landlord may only add to the rent 1/168th of such IAI’s to a vacancy rent. That’s about $89. In addition, major capital improvement expenditure increases (“MCI’s”) have been curtailed. It is beyond the scope of this already-long article to go into the details on MCI’s. Again, I encourage anyone contemplating MCI’s to read the new law carefully.

Long story short, the rent rolls for buildings containing Rent Stabilized apartments can be expected to increase much more modestly than before HSTPA.

C. Preferential Rent remains in place for a whole tenancy.

The new law reforms Preferential Rents. The new law:

- Prohibits owners who offer tenants a “preferential rent,” or rent below the legal regulated rent, from discontinuing the use of preferential rent or raising the rent to the full legal amount upon lease renewal.

- But it allows landlords to charge any rent up to the full legal regulated rent once the tenant vacates the unit, as long as the tenant did not vacate due to the owners failure to maintain the unit.

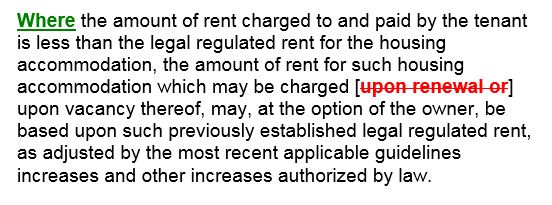

This is the text of the new law (the green words were added, and the red words were stricken):

D. Momentous Changes to Rent Overcharge Laws

When it comes to the new laws, everyone seems to be talking about de-regulation and rent increases and, of course, those are important issues. But a close-second in importance are the momentous changes to the Rent Stabilization laws regarding rent overcharges.

1. There is no statute of limitations on an overcharge claim.

First, there is no longer any statute of limitations on a rent overcharge! Formerly, there was a four-year statute of limitations (CPLR § 213-a). That meant that an overcharge claim had to be filed within four years of the last overcharge. Now CPLR § 213-a states, “…an overcharge claim may be filed at any time…” This means that many more tenants will be eligible to file overcharge claims.

2. A court or the DHCR can look back as far as it wants and at as many sources of information as it deems appropriate, when attempting to determine if there is an overcharge and at what level the legal rent should be set.

Furthermore, a court or the DHCR can look back as far as it wants and at as many sources of information as it deems appropriate, when attempting to determine if there is an overcharge and at what level the legal rent should be set. Before this amendment to the law, a court or DHCR could only look back four-years when determining if there was an overcharge, unless there was evidence of fraud and in some other limited circumstances.

Let us look at all the material added to the law to give a court or DHCR latitude in overcharge matters:

“The [DHCR], and the courts, in investigating complaints of overcharge and in determining legal regulated rents, shall consider all available rent history which is reasonably necessary to make such determinations, including but not limited to:

(i) any rent registration or other records filed with [DHCR], or any other state, municipal or federal agency, regardless of the date to which the information on such registration refers;

(ii) any order issued by any state, municipal or federal agency;

(iii) any records maintained by the owner or tenants; and

(iv) any public record kept in the regular course of business by any state, municipal or federal agency. Nothing contained in this subdivision shall limit the examination of rent history relevant to a determination as to:

(i) whether the legality of a rental amount charged or registered is reliable in light of all available evidence including but not limited to whether an unexplained increase in the registered or lease rents, or a fraudulent scheme to destabilize the housing accommodation, rendered such rent or registration unreliable;

(ii) whether an accommodation is subject to the emergency tenant protection act or the rent stabilization law;

(iii) whether an order issued by the [DHCR] or by a court, including, but not limited to an order issued pursuant to section 26-514 of this chapter, or any regulatory agreement or other contract with any governmental agency, and remaining in effect within six years of the filing of a complaint pursuant to this section, affects or limits the amount of rent that may be charged or collected;

(iv) whether an overcharge was or was not willful;

(v) whether a rent adjustment that requires information regarding the length of occupancy by a present or prior tenant was lawful;

(vi) the existence or terms and conditions of a preferential rent, or the propriety of a legal registered rent during a period when the tenants were charged a preferential rent;

(vii) the legality of a rent charged or registered immediately prior to the registration of a preferential rent; or

(viii) the amount of the legal regulated rent where the apartment was vacant or temporarily exempt on the date six years prior to a tenant’s complaint.”

[Emphasis supplied.]

These changes to the Rent Stabilization laws regarding rent overcharges were made to stem the problems I discussed at the beginning of this article and in several of my earlier articles. Bad landlords counted on the passage of time to insulate them from their indiscretions with a rent roll. Before these changes, if a landlord illegally raised the rent, all the landlord had to do was wait and hope that no tenant challenged the illegal jump in the next four-years. The HSTPA eliminates this loophole. I will provide examples, so you can see how sweeping these changes are.

Example of How the Overcharge Law Worked Before June 2019: In 2004 (15 years ago), a landlord illegally jumped the rent ahead from $600 per month to $1,600 per month. But after that big jump, the landlord only took legal increases. It’s 2018 and a tenant asks the DHCR to determine whether she has been overcharged. The DHCR can only look back 4 years (to 2014). When it looks back to 2014 and examine the rent increases landlord implemented since then, they all check out. The landlord in this example got away with the illegal jump in 2004.

Example of How the Overcharge Law Works Now: In 2004 (15 years ago), a landlord illegally jumped the rent ahead from $600 per month to $1,600 per month. But after that big jump, the landlord only took legal increases. It’s July 2019 and a tenant asks the DHCR to determine whether she has been overcharged. The DHCR can look back all the way to 2004 and question the $1,000 jump. The DHCR (or a court, by the way) can look at any rent registration or other records filed with the DHCR, any orders in any earlier cases or issued by HPD for violations, any records maintained by the owner or tenants, etc. Maybe the landlord is claiming it did $40k of work in the apartment in 2004. But maybe tenant has pictures from 2004, when she moved in, showing that the apartment was not newly renovated at that time.

3. There were radical changes to the treble damage section of the law and attorneys’ fees are now mandatory.

The most radical changes to the overcharge laws, however, are contained in the damages section. Before these amendments to the Rent Stabilization law, a court or DHCR could award a tenant up to four years of damages for an overcharge. With these amendments, however, now a court or the DHCR can award a tenant up to six years of damages for an overcharge.

Moreover, what makes overcharge findings so devastating to landlords is the punitive damages section built into the law, and those sections in this new law are on steroids. Before these changes to the law, a landlord caught overcharging a tenant could simply refund the overcharged amount and avoid any punitive damages. The new law removes the ability of owners to avoid punitive damages if they voluntarily return the amount of the rent overcharge prior to a decision being made by a court or the DHCR. And wow are the new damages punitive!

Under the new law, if a court or a DHCR finds that an overcharge is willful, it can order that the landlord refund to tenant not only the amount it overcharged tenant, but also triple the amount of the overcharge for six full years. Before the change in the law, a court or DHCR could only award two years of triple damages.

Let’s look at another (rough) example to see the impact of this change:

Finally, the new law makes is mandatory (not up to DHCR’s or a court’s discretion, as was the case up until June 14, 2019) to award an overcharged tenant costs, reasonable attorney’s fees, and interest for the overcharge.

IV. PREDICTION – EPIC BATTLES OVER ILLEGALLY DEREGULATED APARTMENTS. EPIC!!!

I do not like making predictions, but that is what everyone asks for. So, here’s what I foresee.

Every apartment that gets swatted back into Rent Stabilization is never…coming…out. And now it’s easier to get an apartment wrongly deregulated back into Rent Stabilization, because of the enhanced look-back options built into the new law. And when an apartment goes back into Rent Stabilization, its going in with a healthy overcharge award. With these new laws, tenants have much greater incentives to challenge the regulatory status of their apartment. And would-be multifamily purchasers have greater incentive to question the efficacy of alleged deregulations.

This will be the new battlefield in the wake of these new laws. Landlords were the hunters (the ones bringing frequent cases against tenants), and now they shall be the hunted (the ones defending against cases brought by tenants), as Legal Aid and private tenant attorneys seek to push as many of those 250,000 illegally deregulated units back into Rent Stabilization and win an overcharge award along with the re-regulation.

My only concern is that there may not be adequate enforcement of these laws for middle class New Yorkers. Low income New Yorkers have Legal Aid. Higher income New Yorkers have firms like mine. Middle class New York will still need help navigating their rights under these laws. This year, I launched an initiative separate from my law firm, for just this purpose – the Tenant Learning Platform. Unfortunately, the TLP is still too young to tackle illegal deregulation. But stay tuned…

V. WHAT OPPORTUNITIES STILL EXIST FOR REAL ESTATE INVESTORS

There are several sectors of multifamily investment that are unaffected by the HSTPA. There are still assets that investors can purchase that contain Rent Stabilized apartments that will deregulate themselves by operation of law. These include:

A. Blocks of Co-Op Sponsor Apartments

I see nothing in these new laws that prevents a co-op apartment long occupied by a non-purchasing tenant who is currently Rent Stabilized, from becoming deregulated when the tenant finally surrenders the apartment, at which point the unit can be sold to a shareholder. I have several clients who invest in blocks of these apartments.

B. Substantially Rehabilitated or New Construction Buildings Where Tax Abatements Expiring

I see nothing in these new laws that prevents a building that is subject to Rent Stabilization SOLELY by reason of the receipt of a tax abatement from deregulating organically at the end of an abatement period. With such buildings, it is crucial that the prospective buyer do Rent Stabilization Due Diligence to make sure that the building does not have a reason, independent of the abatement, for being subject to Rent Stabilization. Moreover, every lease and renewal must be checked for the proper rider language. Absent the right language, tenants will remain Rent Stabilized after the expiration of the abatement.

C. Legitimately Deregulated Apartments

Nine out of ten alleged deregulations that I analyze are illegitimate and those apartments belong back in Rent Stabilization. That still leaves one in ten, however, that were correctly deregulated. As I suggested above, those apartments are going to be worth their weight in gold. They are out there; investors just have to invest in Rent Stabilization Due Diligence to find them.

On June 20, 2019, the legislature added an addendum to the new law, clarifying that, “any unit that was lawfully deregulated prior to June 14, 2019 shall remain deregulated…”

D. Development

I see nothing in these new laws that prevents an owner from applying to DHCR for permission not to renew Rent Stabilized leases because the applicant-owner has shown DHCR approved plans from the New York City Department of Buildings for a new building and a legitimate loan commitment to finance such project. The only change to this type of application I see is that a judge can give a tenant relocated pursuant to such non-renewal up to a year to relocate. Over the years I have been consulted by many owners about this option. Many of them were unenthusiastic when I reminded them that the new building would be subject to a new tax assessment. But tax abatements in exchange for a period of rent regulation are also available. I predict that these new laws will cause various owners to reconsider the development option. That’s probably a good thing, inasmuch as this increases the amount of affordable housing in New York City.

VI. 421-a(16) EXCEPTION

The STPA was amended on June 20, 2019 to state that:

“a market rate unit in a multiple dwelling which receives benefits pursuant to subdivision 16 of section 421-a of the real property tax law shall be subject to the deregulation provisions of rent stabilization as provided by law prior to June 14, 2019.”