One of the few exceptions that would take an apartment in a building out of Rent Stabilization was “High Rent Vacancy Deregulation”.

High Rent Vacancy Deregulation occurred when an apartment’s legal regulated rent had reached a prescribed deregulation threshold (“DRT”). Rent Stabilization Law (“RSL”) § 26-504.2(a). The High Rent Vacancy Deregulation threshold from 1993 forward was $2,000.00, then after January 23, 2011 the threshold was $2,500.00, then after July 1, 2015 the threshold became $2,700.00 (and increased slightly thereafter).

On June 14, 2019, High Rent Vacancy deregulation was abolished by the Housing Stability and Tenant Projection Act of 2019 (“HSTPA”). Although High Rent Vacancy Deregulation was abolished, as per the HSTPA, past deregulations are still valid. RSL § 26-504.2. Moreover, High Rent Vacancy Deregulation is still available in 421-a “Affordable Housing NY Program” buildings, which will be addressed below.

1. A Court or the DHCR Can Look Back Forever When Making a Call on the Rent Regulatory Status of an Apartment

Before we go further into our exploration of High Rent Vacancy Deregulation, it is very important to keep in mind that a court or the DHCR can look back as far as they want to determine whether an apartment is subject to Rent Stabilization. 72A Realty Associates v. Lucas, 28 Misc.3d 585 (N.Y.City Civ.Ct., 2010), Affirmed as Modified by 72A Realty Associates v. Lucas 32 Misc.3d 47 (AT1st 2011), Affirmed as Modified by 72A Realty Associates v. Lucas, 101 A.D.3d 401 (1st Dept. 2012); Gersten v. 56 7th Avenue LLC,88 AD3d 189 (1st Dept. 2013). See also NYC Admin Code § 26-516(h), which allows a court or DHCR, “in investigating complaints of overcharge and in determining legal regulated rents, [to] consider all available rent history which is reasonably necessary to make such determinations…” This is why we look back throughout an apartment’s history from the 1980’s forward and test that history against the following laws, which applied at relevant times.

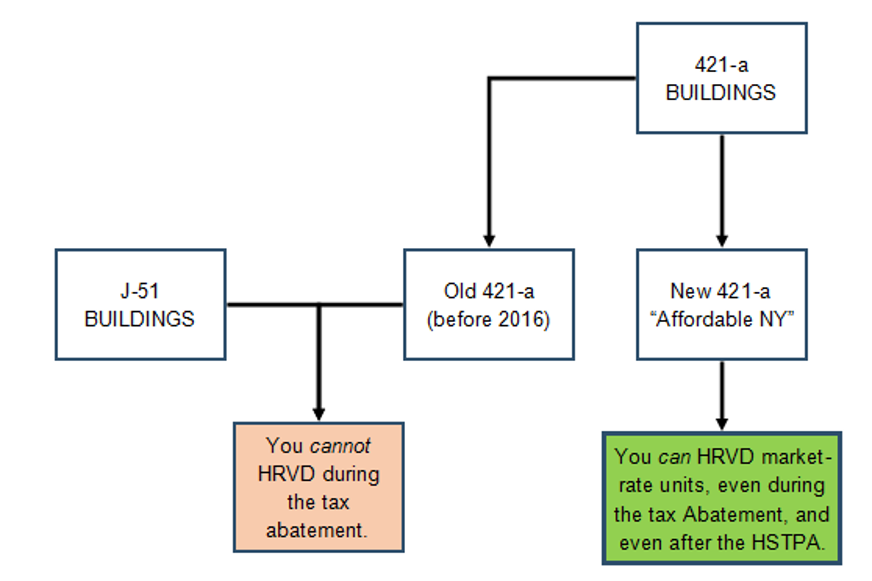

2. High Rent Vacancy Deregulation is Not Allowed if a Building is Stabilized Pursuant to a Tax Exemption or Abatement Program

High Rent Vacancy Deregulation is not allowed, however, while a building is Stabilized pursuant to a tax exemption or abatement program. Roberts v. Tishman Speyer, 13 NY3d 270 (2009); Roberts v. Tishman Speyer Properties, 89 A.D.3d 444 (1st Dept. 2011); Gersten v. 56 7th Avenue LLC, 88AD3d 189 (1stDept. 2013); 72A Realty Associates v. Lucas, 101 A.D.3d 401 (1st Dep’t 2012). An exception to this rule would be in 421-a “Affordable Housing NY Program” (defined below) buildings.

Rent Stabilized units in buildings benefiting from 421-a tax benefits before 2016, were not allowed to use High Rent Vacancy Deregulation, while the tax benefit was in place. However, RPTL § 421-a was revamped in 2017 as the “Affordable Housing NY Program” and made retroactive to 2015. Affordable Housing New York Program projects are divided into affordable portions and market rate portions. In the market rate portion of such a project, the market rate units are Rent Stabilized, but their first rent is set at a market rate. Significantly, market rate units in Affordable Housing NY Program 421-a buildings are Rent Stabilized while tax abatements are in effect unless the units (not in the affordable portion) meet the criteria for luxury deregulation. The HSTPA did not originally include a carve-out for High Rent Vacancy Deregulation of market rate units in buildings benefiting from Affordable Housing NY Program 421-a. A corrective bill was passed clarifying that Affordable Housing NY Program 421-a buildings will continue to be subject to pre-2019 Rent Stabilization laws. The HSTPA was amended on June 20, 2019 to state that:

“a market rate unit in a multiple dwelling which receives benefits pursuant to subdivision 16 of section 421-a of the real property tax law shall be subject to the deregulation provisions of rent stabilization as provided by law prior to June 14, 2019.”

The net effect of all this legislation is that in Affordable Housing NY Program 421-a buildings, landlords can be High rent Vacancy deregulated, even after June 15, 2019 and even if the 421-a tax benefits are still in place.

3. High Rent Vacancy Deregulation and Individual Apartment Improvements

Before the HSTPA in 2019 eliminated High Rent Vacancy Deregulation, landlords were always eager to get to the DRT. One way to hasten getting there was to do Individual Apartment Improvements (“IAIs”). A landlord may secure a rent increase based on a substantial modification of dwelling space and/or upon provision of additional services, improvements, equipment, furniture, or furnishings to a Rent Stabilized unit. RSL § 26-511(c)(13); RSC § 2522.4(a)(1). No tenant consent is required when the IAI is made during a vacancy. RSC § 2522.4(a)(1).

DHCR distinguishes between “improvements” and “repairs” or “maintenance” in determining whether the work qualifies for the increase. Rockaway One Co., LLC v. Wiggins, 9 Misc. 3d 12 (App. Term 2004), order rev’d on other grounds, 35 A.D.3d 36 (2d Dep’t 2006).[1]

Before the HSPTP in 2019, in a building with 35 or fewer apartments, a landlord was allowed to add to a Rent Stabilized tenant’s rent the equivalent of one-fortieth (1/40) of the cost of the new service or equipment, including installation costs, but not finance charges. RSL Code § 26-511(c)(13); RSC § 2522.4(a)(4). For example, if a new refrigerator was installed in an apartment and the landlord’s expense was $400.00, then the tenant’s monthly rent was increased by $10.00 (1/40 x $400). This kind of IAI was often used to juice the rent to the Deregulation Threshold.

It is crucial to consider, however, that IAI’s are receiving heightened scrutiny. DHCR issued Operational Bulletin 2016-1 “Individual Apartment Improvements”, which deals extensively with the types of proof the DHCR requires of a landlord who wants to substantiate IAI’s, and which states:

Claimed individual apartment improvements are required to be supported by adequate and specific documentation, which should include:

1. Cancelled check(s) (front and back) contemporaneous with the completion of the work or proof of electronic payment;

2. Invoice receipt marked paid in full contemporaneous with the completion of the work;

3. Signed contract agreement; and

4. Contractor’s affidavit indicating that the installation was completed and paid in full.

It is rare that a landlord actually has her act together to the extent I would like to see it with respect to IAI’s. Here are some examples of what I see frequently:

· The cancelled checks do not indicate what invoices were being paid.

· There are no invoices marked “paid”.

· The amounts of certain expenditures do not match up with the invoices.

· The invoices are chronologically discordant with the alleged work.

· Landlord does not provide signed contracts; they have paper, but not contracts.

· Landlord does not provide contractors’ affidavits.

· Landlord does not provide before and after pictures of the apartment.

A simple technique that I always instruct my landlord-clients to engage in is to take before and after pictures of the renovation, a picture being worth a thousand words (or a thousand invoices, cancelled checks, and contractor’s affidavits).

4. High Rent Vacancy Deregulation After June 15, 2015

On or after June 15, 2015, the wording of the law was changed to indicate that an apartment may not be High Rent Vacancy Deregulated until the rent reaches the DRT with a Rent Stabilized tenant in occupancy. Therefore, if the rent is below that threshold when a Rent Stabilized tenant moves out, the apartment remains Rent Stabilized even if the new rent rises above the DRT. See NYC Admin Code. § 26-403(E)(2)(k).

In People’s Home Improvement LLC v. Kindig, NYLJ ID1572250769NY6542119, (Civil Court Kings County, September 6, 2019), tenant-Kindig moved to dismiss a nonpayment proceeding arguing the petition failed to state a cause of action, because the premises were subject to Rent Stabilization. Landlord cross-moved claiming the premises was deregulated, based on High Rent Vacancy Deregulation. Kindig argued that petitioner could not deregulate the premises under High Rent Vacancy Deregulation in 2017, as such deregulation may only occur when a unit is vacated after reaching the $2,700 threshold rent, including applicable one-year renewal increases. The court agreed, ruling that the Rent Act of 2015 did not intend to permit deregulation of a vacant apartment below the threshold rent through vacancy or IAI increases if the vacancy occurred after the Act’s effective date. Thus, it found Kindig was a Rent Stabilized tenant and granted him dismissal of the petition as it failed to properly set forth his regulatory status.

5. High Rent Vacancy Deregulation and Preferential Rent

Finally, we need to talk about High Rent Vacancy Deregulation and “Preferential Rent”, defined below.

“An apartment will also qualify for deregulation upon vacancy by the tenant, where a preferential rent of less than $2,500 per month is charged and paid and a higher legal regulated rent has been established.” DHCR Fact Sheet # 36; See RSC § 2520.11[r][5]; [s][2].

However, there is heightened scrutiny of a rent roll when there are preferential rents as per RSC § 2521.2(Preferential rents):

(a) Where the amount of rent charged to and paid by the tenant is less than the legal regulated rent for the housing accommodation such rent shall be known as the ”preferential rent.” The amount of rent for such housing accommodation which may be charged upon renewal or vacancy thereof may, at the option of the owner, be based upon either such preferential rent or an amount not more than the previously established legal regulated rent, as adjusted by the most recent applicable guidelines increases and other increases authorized by law.

(b) Such legal regulated rent as well as preferential rent shall be set forth in the vacancy lease or renewal lease pursuant to which the preferential rent is charged.

(c) Where the amount of the legal regulated rent is set forth either in a vacancy lease or renewal lease where a preferential rent is charged, the owner shall be required to maintain, and submit where required to by DHCR, the rental history of the housing accommodation immediately preceding such preferential rent to the present which may be prior to the four-year period preceding the filing of a complaint.

[Emphasis supplied.]

This statute is in place because many landlords have abused Preferential Rents. Landlords illegally raised legal rents, with the intention of hastening illegal deregulations. But because tenants were only being charged the Preferential Rent, tenants did not feel the pain of the unlawful legal rent and, therefore, did not report it to DHCR. The years would go by, and then the four-year look back period (now repealed) would prevent a future tenant from looking back to question the progression of the legal rents and the subsequent deregulation. Thus, the legislature made the above statute, so that courts and the DHCR could examine a landlord’s records as far back as they desired when Preferential Rents were utilized. This is now somewhat obviated by the HSTPA mandate for a court to look as back as far as it wants under any circumstances. However, it remains a strong indication that Preferential Rents will continue to be closely scrutinized in deregulation cases.

Footnote

[1] Do NOT confuse, as many people do, IAI’s with MCI’s (major capital improvements). The following are the major characteristics of MCI’s:

- MCI require the consent of DHCR.

- MCI’s are for building-wide systems that directly or indirectly benefit ALL tenants.

- MCI’s are associated with a great deal of paperwork (form RA-79)

- To qualify as an MCI and improvement or installation must:

- Be depreciable pursuant to the IRS Code, other than for ordinary repairs

- Be for the operation, preservation, and maintenance of the building

- Meet the requirements set forth in a useful life schedule contained in the applicable regulations. For example, you can only apply for an MCI increase for a cast iron boiler every 35 years.

- The rent increase collectible in any one year may not exceed 6% of the tenant’s rent.

- The back-up proof required to document MCI’s includes (but is not limited to) certifications by contractors, proof of payment, copies of approvals from government agencies, and a list of tenants, contracts, and contractor affidavits.

- You must apply for MCI’s within two years of the work being complete.